Private Equity Case Study: BJ's Wholesale

How BJ's Wholesale doubled EBITDA under the guidance of Leonard Green & Partners and CVC Capital.

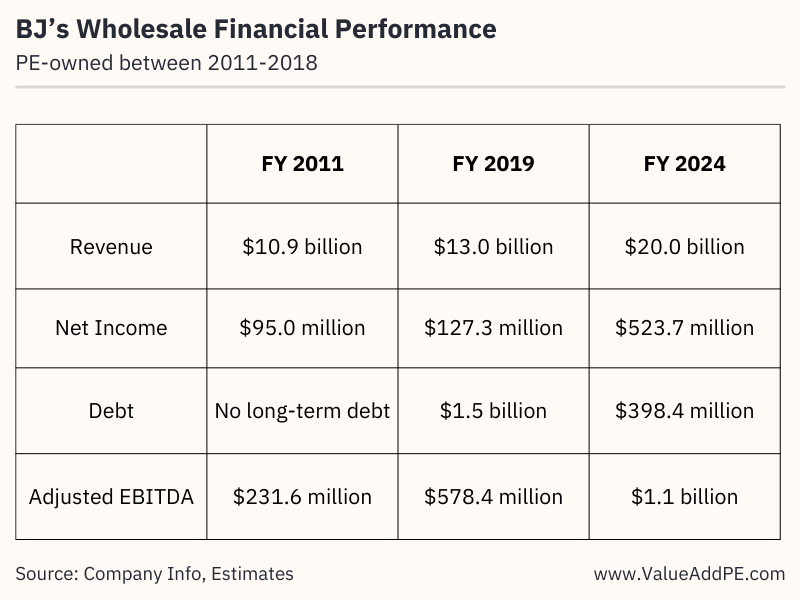

In 2011, BJ’s Wholesale Club faced challenges as it entered its third decade in operation. The company was grappling with diminishing returns from new store openings and increasing competition from eCommerce platforms, despite reporting nearly $11 billion in revenues, up +8% year-over-year, and maintaining no long-term debt. A -27% drop in net income to $95 million highlighted operational difficulties, particularly with five underperforming stores in the southeast US, leading to several executive resignations.

This case study provides an analysis of BJ’s financial and operational trajectory from its buyout by Leonard Green & Partners (LGP) and CVC Capital through subsequent years. It will focus on the strategic initiatives undertaken during private equity ownership and their impact on the company’s market position and financial health, underpinned by a detailed examination of financial metrics and market dynamics.