Endeavor Becomes Largest Take-Private Deal in 10+ Years

Plus: Paramount snubs Apollo offer, EQT acquires Avetta, and more.

Spotlight

Silver Lake has announced the acquisition of Endeavor, a sports and entertainment conglomerate owning holding companies WME and IMG, along with assets such as bull riding league PBR, betting data firm OpenBet, marketing agency 160over90, and hospitality firm On Location. The deal values Endeavor at $25 billion, the largest PE-backed take-private deal in more than 10 years. The announcement comes three years after Endeavor initially went public and 12 years after Silver Lake first-invested in the company.

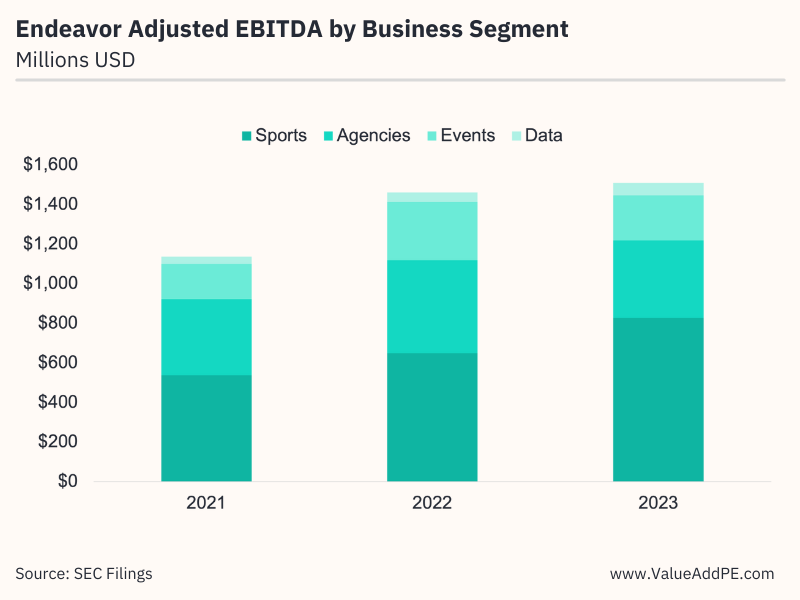

During 2023, Endeavor strengthened its position in sports and entertainment by acquiring TKO, the parent company of UFC and WWE. This resulted in annual revenues increasing +36% in the “Owned Sport Property” segment to $1.8 billion in 2023. Endeavor’s overall company performance has steadily increased over the years, reporting a CAGR of +8% in annual revenue since 2021 to $6 billion in 2023, and a CAGR of +18% in adjusted EBITDA to $1.2 billion. Despite the earnings growth, Endeavor is currently trading about -25% lower than its high in 2021.

Shortly after Silver Lake’s initial investment in 2012, Endeavor pursued an aggressive M&A strategy — something that Silver Lake Managing Director Stephen Evans suggests will continue. “Marked by more than $3.5 billion of direct investment across six distinct transactions over [the previous] 12 years. We are excited about what we can achieve together in this next phase.” Public market investors have been skeptical that Endeavor can effectively manage and grow newly acquired businesses in its portfolio, but Silver Lake views that diversification as an advantage.