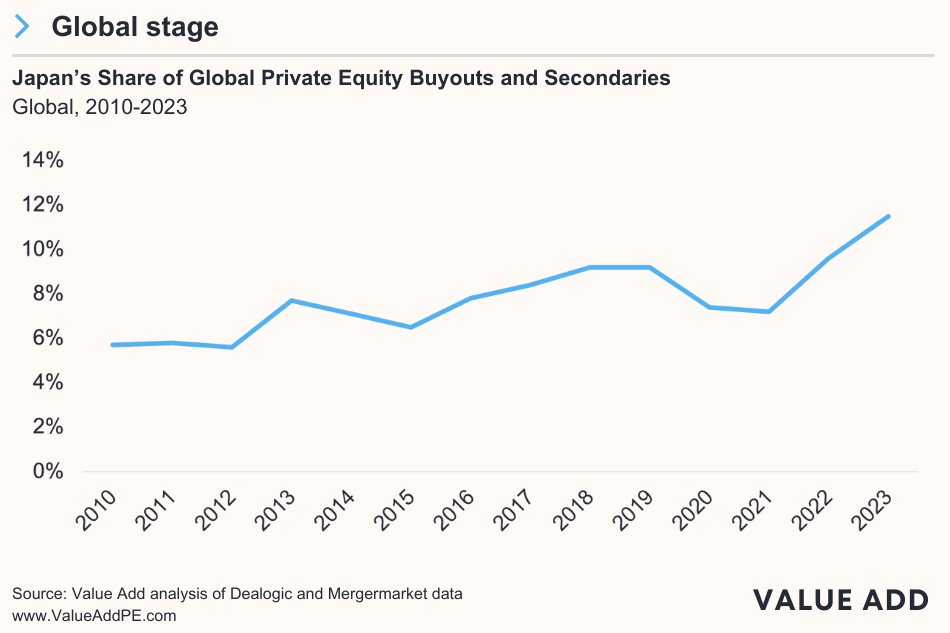

Japan's Share of Global Buyout Activity Reaches All-Time High

Japan now accounts for 12% of global buyouts.

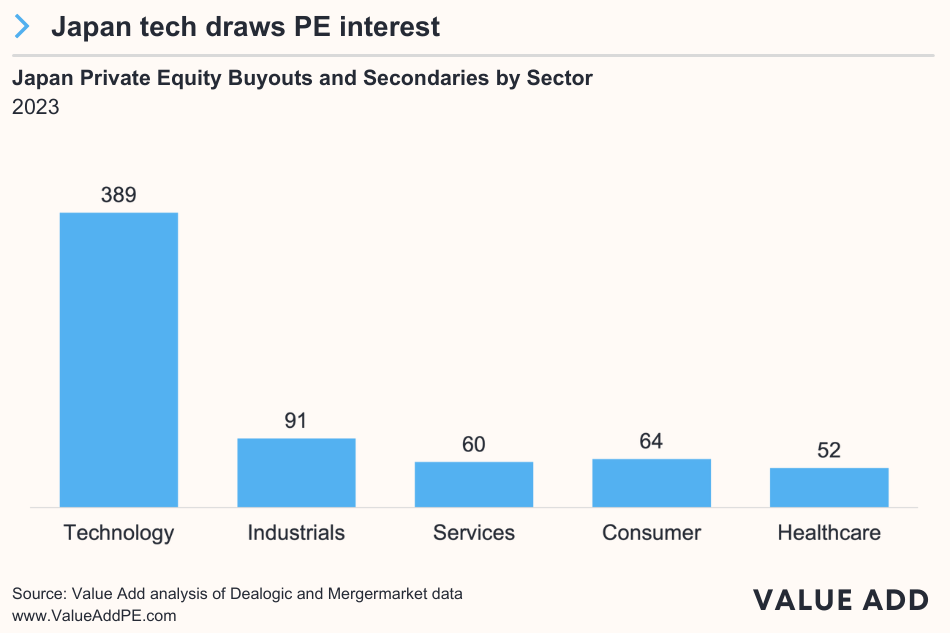

Amid the global slowdown in private equity deal making there has been a subtle, yet definitive shift in buyout activity toward Japan. While Asia has seen a significant downturn, with private equity buyouts and secondary deals falling by -28% to a low not seen in nine years, Japan's buyout market has been more resilient, experiencing a smaller decline of -14%. Japan now ranks as the most-active market for buyout and secondary transactions in Asia and holds the position of the second most-active buyout market on a global scale, based on Mergermarket and Dealogic data analysis. What’s more, Japan’s share of global private equity buyouts reached an all-time high of 12% in 2023, surpassing the UK, and second only to the US.

The relative resilience of private markets in Japan suggests that PE firms are bullish on the long-term prospects of Japanese companies. KKR CEO Scott Nuttall recently said that Japan is the “most-interesting” market for traditional buyouts at the moment, comparing it to the US or Europe “maybe 30 years ago.” Meanwhile, Blackstone’s Steven Schwarzman says the firm is planning to offer investors more financial products to gain exposure to Japan’s economy.