Oaktree Sells Boardriders, Accell-KKR Takes Stake in StoreForce, Garnett Acquires Firebirds

Private equity news for the week of April 3, 2023.

Welcome to the first issue of Value Add - a weekly newsletter for private equity operators. You can subscribe here.

Insights

Private Equity is Helping Tech Companies Cut Costs

PE firms injected billions of dollars into the tech sector, now they’re helping the industry balance growth with financial prudence. (Read More)

Operating Partners Are Playing a Bigger Role in PE Firms

With borrowing costs on the rise, many PE firms are shifting their focus from financial engineering to operational improvements. (Read More)

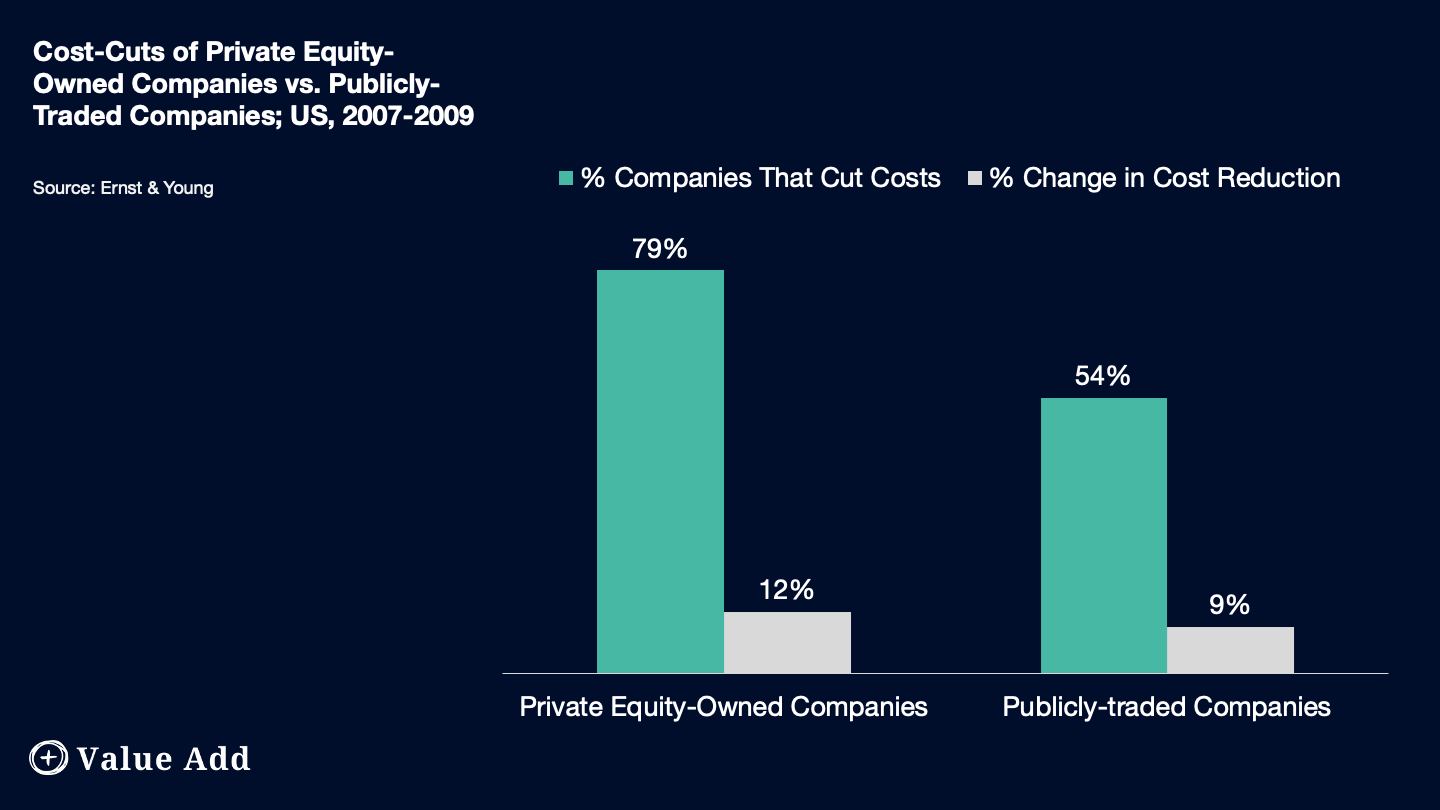

Chart of the Week: During the 2007-2009 recession, 79% of private-equity owned companies implemented cost-cutting measures representing a 12% average cost reduction at their firms compared to 54% of publicly-traded companies that cut costs with an average cost reduction of 9%.

Deal News

Oaktree Capital Management is selling sports and lifestyle company Boardriders — the parent company of Quicksilver, Billabong, and Roxy — to Authentic Brands Group for a reported $1.3B. Oaktree originally acquired the company in 2016 after it filed for bankruptcy. Authentic Brands is known for its portfolio of apparel brands and retailers including Nautica, IZOD, and Brooks Brothers; the company also licenses brands such as Reebok. (Source)

Accel-KKR is taking a major stake in retail solutions provider StoreForce. The investment will fund the company’s global expansion and M&A opportunities. Storeforce helps current clients such as Asics, Crate & Barrel, and Tory Burch with store-level retail operations including workforce management and employee engagement. (Source)

Garnett Station is acquiring restaurant chain Firebirds for an undisclosed amount from J.H. Whitney Capital Partners, which acquired the company in 2019. Firebirds has 56 restaurant locations across 20 states, and has been experiencing strong growth in recent years. Sales were up 59% YoY to $247M in 2021, according to Technomic, driven by new menu options, delivery partnerships, and online ordering. (Source)

German airline Deutsche Lufthansa is selling its in-flight catering business, LSE Group, to private equity firm Aurelius. The business has reportedly been up for sale since 2019 - but uncertainty around travel during the COVID-19 pandemic scared away potential suitors. Lufthansa says selling LSE Group will allow it to focus on its core airline business; the company’s stock is down -66% since April 2018, but up +32% YTD 2023. (Source)

Industry News

The Wall Street Journal says niche sports like rugby and motor-cross are attracting PE firms. (Source)

PE analysts and associates, who rank low on carry pay-out, should expect smaller bonuses for the next few years (Source)

KKR & Co raised a big new fund for European investments (source)

Have a great rest of your week. Subscribe if you want the next newsletter emailed to you.