What Happened to Leonard Green-backed DIY Retailer Joann?

Portco news and analysis the week of March 25th, 2024.

Spotlight

Crafts retailer Joann, formerly known as Joann Fabric and privately-owned by Leonard Green & Partners between 2011 to 2021, filed for bankruptcy last week. The company announced that it reached an agreement with lenders to provide $132 million of new financing in exchange for a court-supervised financial restructuring that will reduce its debt by $505 million. The retailer says there will be no disruption to stores or supplier agreements.

The company went public in early-2021 as demand for its products enjoyed a pandemic-related boom while public health concerns kept many consumers at home and boosted demand for crafts and DIY projects. Joann went on to face a rapid retreat in demand soon thereafter, however, as fading pandemic tailwinds in 2022 and 2023 coincided with a surge in inflation, crimping households’ willingness to spend on discretionary retail. The company has responded to recent headwinds by implementing cost savings measures in recent months, including layoffs and a modest reduction in store count. However, progress thus far has seemingly been insufficient to offset declining sales.

Joann’s YoY revenue has been declining for ten consecutive quarters, and trailing 12-month EBITDA fell from a peak of $288 million in April 2021 to -$118 million in October 2023. Meanwhile, long-term debt has been trending higher, from $779 million in Q1 2022 to $1.1 billion at the end of last year – constituting a +47% increase. The company is expected to hire a new CEO to lead the bankruptcy transition. Leonard Green is still a major shareholder in Joann, so it wasn't a clean exit for the firm. The outcome suggests the DIY market simply fell-out from under the investment thesis.

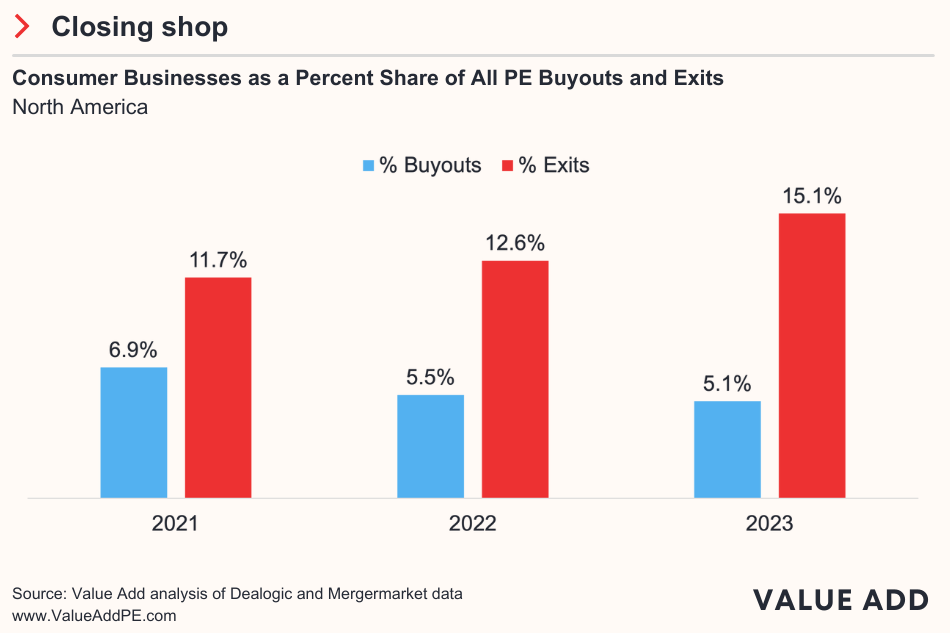

Joann’s financial struggles are another example of why private equity firms are growing wary of consumer businesses. Rising credit card debt, higher-than-expected inflation, and eroding barriers to entry have made consumer goods and retail companies risky investments for buyout firms. Consumer businesses accounted for 15% of PE-backed exits in 2023, but only 5% of buyouts, according to data from Dealogic and Mergermarket.

In other portco news …