Will Private Equity Acquire Spindrift?

Buyout news and analysis the week of April 1st, 2024.

Deal Spotlight

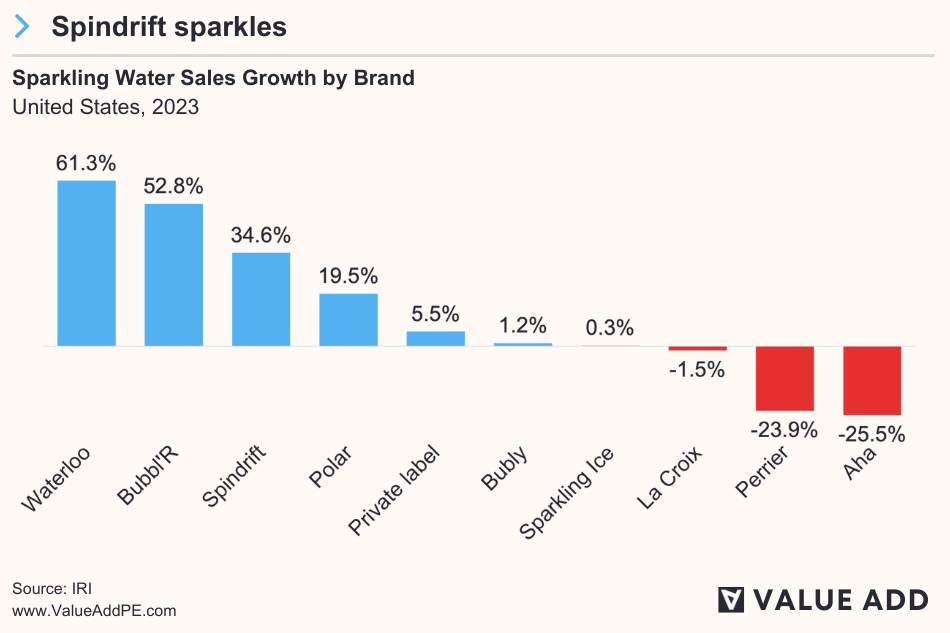

Spindrift Beverage Co., a popular sparkling water brand in the US, is said to be considering a sale or merger. The brand differentiated itself early-on in a crowded CPG category by claiming to be the first sparkling water in America that uses real squeezed fruit. Spindrift reportedly brought in $300 million of revenue the past 12 months, driven by strong distribution in major retailers such as Kroger, Publix, and Whole Foods.

Strategic acquisitions are fairly common in the CPG space, with PepsiCo and Coca-Cola often acquiring fast-growing consumer brands. In 2018, PepsiCo acquired SodaStream for $3.2 billion and also launched its own sparkling water brand called Bubly. Coca-Cola is also reportedly in talks to acquire carbonated beverage brand Poppi. It’s very likely that Spindrift could pursue a strategic acquirer — in fact, the company’s founder, Bill Creelman, previously sold another beverage brand to Diageo.

However, if strategic acquirers don’t believe they need Spindrift to take market share, the company might otherwise pursue the growth or venture arms in private equity. Buyout firms are generally decreasing their exposure to consumer businesses, but some are still very active in the space.

Blackstone’s growth fund for example holds majority stakes in non-dairy brand Oatly and skincare brand Supergoop. There are also several middle-market PE firms which specialize solely in food and beverage brands, such as Arbor Investments. PE firms are also partnering with major retailers to help them invest in fast-growing CPG brands. For example, MidOcean Partners recently launched a new investment vehicle, called MPearlRock, in partnership with Kroger’s. MPearlRock completed its first investment two months ago, acquiring a dairy-free creamer brand called Nutpods, which coincidentally is backed by VMG partners — the same venture capital firm that led Spindrift’s Series B funding.

Spindrift is still relatively small enough as a company, that an additional round of venture or growth investment could propel the brand to a much larger exit to a strategic acquirer in 4-5 years. For example, Spindrift could launch new flavors and verticals, or expand internationally, as the brand’s products are currently only available in the US.