L Catterton Taking Birkenstock Public, New Relic's $6.5B Take-Private, Plan B Maker For Sale

Private equity news the week of July 31st, 2023.

Insights

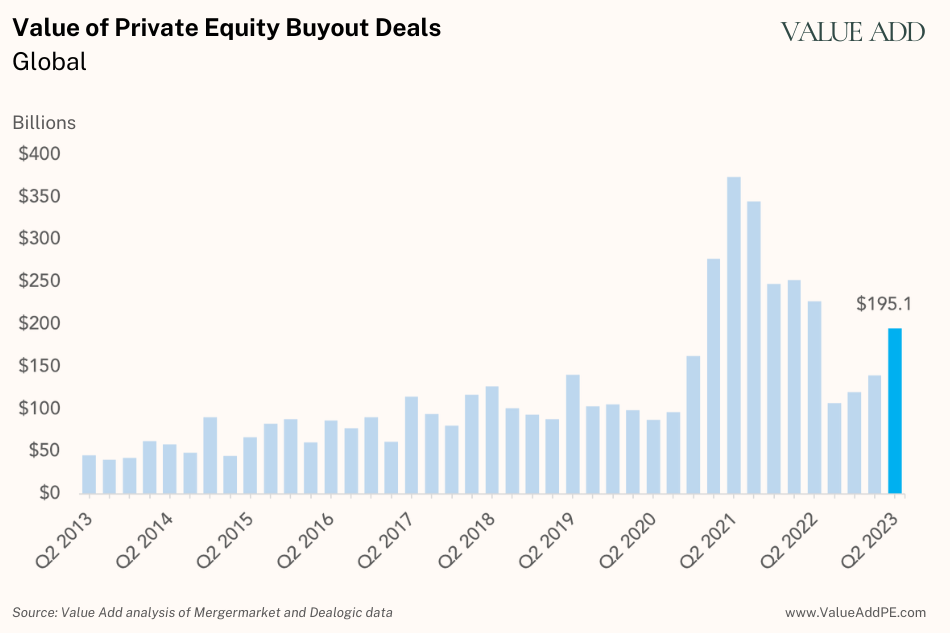

Chart of the Week: Private equity firms deployed $195.1 billion of capital globally in Q2 2023, an increase over the previous three quarters. It's a sign that buyout firms are regaining confidence in private markets after pulling back on capital deployment the past 12 months. (Read More)

Reports

Last week we published the Private Equity Buyouts Report: Q2 2023. PRO subscribers can read the 20-page report online or download a PDF copy. (Read)

This week we’ll publish the Private Equity Exits Report: Q2 2023. PRO subscribers will receive their copy on Thursday.

Deal News

L Catterton is gearing up to take portfolio company Birkenstock public in an IPO slated for this September. The PE firm is seeking a valuation of $8 billion for the footwear brand, nearly 2x its valuation from two years ago. Birkenstock has seen strong sales and earnings growth recently, with 2022 revenues up +29% and adjusted earnings coming in at $433 million. The brand has managed to stay not just relevant — but trendy — through fashion cycles. Birkenstock could barely keep its Arizona sandal in-stock during the COVID-19 pandemic, and more recently Vogue called its Boston clog the “new Ugg slippers.” (Source)

Francisco Partners and TPG have agreed to acquire software provider New Relic in a $6.5 billion take-private deal. New Relic has been exploring a sale since July 2022, after being targeted by activist hedge fund Jana Partners. The company provides app monitoring services and competes against the likes of Datadog and Dynatrace. New Relic reported annual revenue growth of +18% in 2022 and the acquisition price is approximately 7x forward-looking 2023 revenues. The deal with Francisco Partners and TPG almost fell-through in late-May as deal makers had trouble securing debt financing. (Source)

Kelso & Co. and Juggernaut Capital Partners have started exploring a sale of Foundation Consumer Healthcare, the OTC healthcare manufacturer behind Plan B contraceptives and Breathe Right nasal strips. The PE firms are reportedly seeking a valuation of around $4 billion for the company. Foundation Consumer Healthcare acquired Plan B and several other brands from Teva Pharmaceutical Industries in 2017 for $675 million. (Source)

TPG has agreed to acquire healthcare software company Nextech from Thomas H. Lee Partners for $1.4 billion. Nextech provides IT solutions, such as medical record keeping, for more than 11,000 physicians and 60,000 clinics. Thomas H. Lee Partners acquired the company for $500 million in 2019 from Francisco Partners. (Source)

Warburg Pincus and Centerbridge Partners are investing $400 million to facilitate the merger of regional banks Banc of California and PacWest Bancorp. In exchange for the capital infusion, the two PE firms are receiving 20% of the combined entity at a share price of $12.30. The valuation is a fraction of what the two banks were valued at prior to a run on the US regional banking sector earlier this year. PacWest’s stock price still trades at -66% vs. February 2023. PacWest has approximately $40 billion of assets under management, whereas Banc of Califonia has about $10 billion in assets. (Source)

The US’s Federal Despot Insurance Corporation (FDIC) is accepting bids for an $18.5 billion loan portfolio that was held by Signature Bank, the now-defunct regional bank. The portfolio consists of 201 loans tied to several private equity firms including Blackstone, Thoma Bravo, and Carlyle Group. Bids will be limited to FDIC-insured depository institutions. (Source)

Bluestone Equity Partners has agreed to acquire a $30 million minority stake in PMY Group, which provides technology and electronics for sports venues. It’s the first investment by Bluestone, which is a new PE firm founded by former-NBA executive and lawyer Bobby Sharma. PMY currently operates equipment in Los Angeles’s SoFi Stadium, Dallas’s AT&T Stadium, New York’s Citi Field, and several others. (Source)

Industry News

Private equity fundraising fell to its lowest level since 2018. Buyout firms raised $106.7 billion in Q2 2023, down -35% YoY, according to Preqin. Higher interest rates have tightened lending conditions, making fundraising particularly difficult on newer firms with little reputation to stand on. That said, some of the largest and most well-known buyout firms have carried on raising money for new funds. For example, CVC Capital Partners just closed a $28.8 billion fund, TA Associates closed a $16.5 billion fund, and Genstar Capital Partners closed a $12.6 billion fund. (Wall Street Journal)

Meanwhile, Singapore’s GIC sovereign wealth fund declared the end of the golden age for private equity. GIC’s Chief Investment Officer Jeffrey Jaensubhakij said high interest rates have lowered valuations in private markets and that some investors are realizing they are “overcommitted” to private equity. Despite Jaensubhakij’s bearish outlook on private markets, GIC increased its portfolio allocation to PE from 9% in 2017 to 17% this year. (Financial Times)

KKR’s Global Co-Head of Private Equity Peter Stavros disagrees with GIC’s outlook on private markets and thinks it’s a “great time” to do deals. Although Stavros is clearly biased in the debate, his argument is that when credit is tight and valuations decline is exactly when the best deals are done. “The money you can borrow is more expensive,” which leads to less fundraising, less competition among buyout firms, and better deals over the long-term, he explained. (CNBC)

Headhunters are noticing private equity analysts and associates leaving mega-funds for middle-market funds. Early-career professionals in particular are saying there is more ownership and responsibility at smaller firms. Indeed, our Q2 2023 Private Equity Buyouts Report showed that there is a lot of high-volume, small buyouts getting done while the blockbuster buyout deals are fewer and far between in today’s market. (Reuters)

Questions? Email us at news@valueaddpe.com